Trolley Payouts: Enterprise Guide to Global Mass Disbursement & Compliance Automation

Introduction

Global platforms operate in an environment where payment efficiency directly impacts growth. Paying affiliates, creators, vendors, or contractors across multiple countries requires reliable infrastructure, compliance oversight, and scalable workflows.

Trolley payouts are designed to centralize these processes. By automating onboarding, documentation, and payment execution, the platform helps organizations manage international disbursement cycles with greater structure and transparency.

This guide provides a strategic overview of trolley payouts and how they support enterprise-scale payment operations.

About Trolley

Trolley is a fintech company focused on mass payout automation for digital businesses. Its system integrates multiple operational layers into one unified platform:

- Secure recipient onboarding

- Global payment orchestration

- Multi-currency support

- Tax documentation collection

- Compliance record management

- Reporting dashboards

Trolley payouts are commonly implemented by marketplaces, SaaS ecosystems, affiliate platforms, and global contractor networks.

Operational Workflow of Trolley Payouts

4

1. Recipient Onboarding & Data Validation

Recipients submit required information via a secure portal:

- Bank or payout details

- Tax documentation

- Identity verification information

Automated validation workflows reduce errors and standardize compliance processes.

2. Payment Orchestration Engine

Trolley payouts support:

- Domestic bank transfers

- Cross-border disbursements

- Multi-currency settlements

- Batch payout processing

This structure enables efficient high-volume payment cycles.

3. Compliance & Documentation Layer

The compliance module assists with:

- Tax form collection

- Documentation validation

- Record storage

- Reporting preparation

These workflows help maintain organized regulatory alignment.

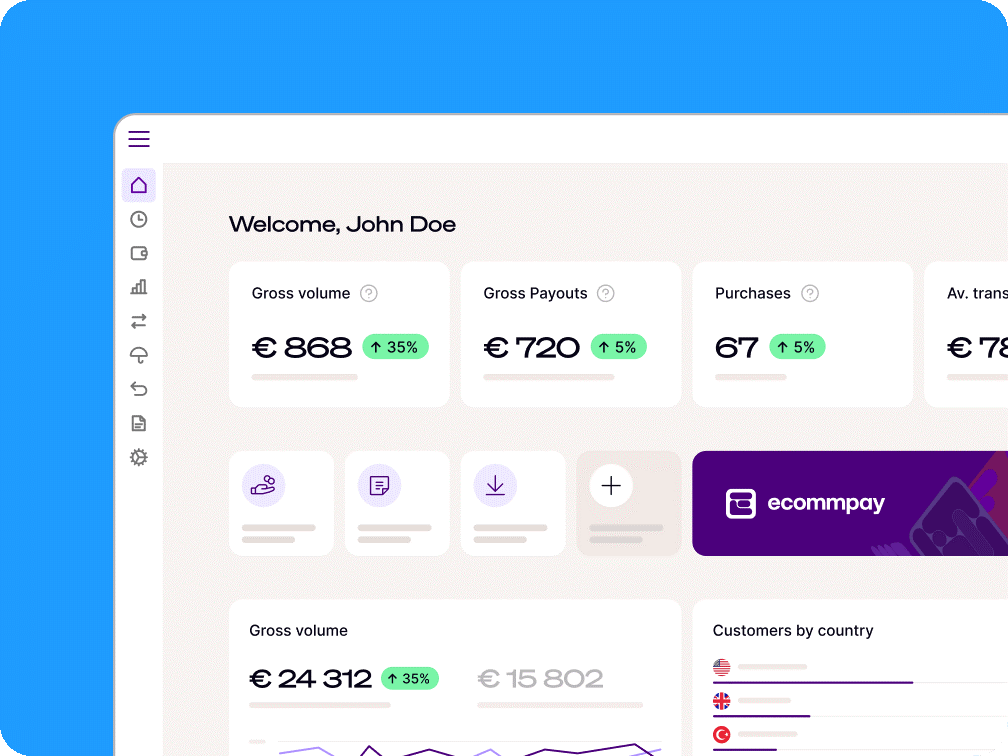

4. Reporting & Financial Oversight

Finance teams gain access to:

- Real-time transaction tracking

- Currency conversion summaries

- Historical payout logs

- Exportable reconciliation files

Central dashboards improve transparency and control.

Core Technical Capabilities

API-Based Integration

Developers can embed trolley payouts into internal platforms through API connectivity, enabling automated triggers and reporting sync.

Multi-Currency Infrastructure

The platform supports disbursement in multiple currencies, simplifying international operations.

Scalable Batch Processing

Bulk payout cycles can handle high transaction volumes efficiently.

Enterprise Security Controls

Security measures typically include:

- Encrypted data transmission

- Role-based permissions

- Activity monitoring

- Audit logs for traceability

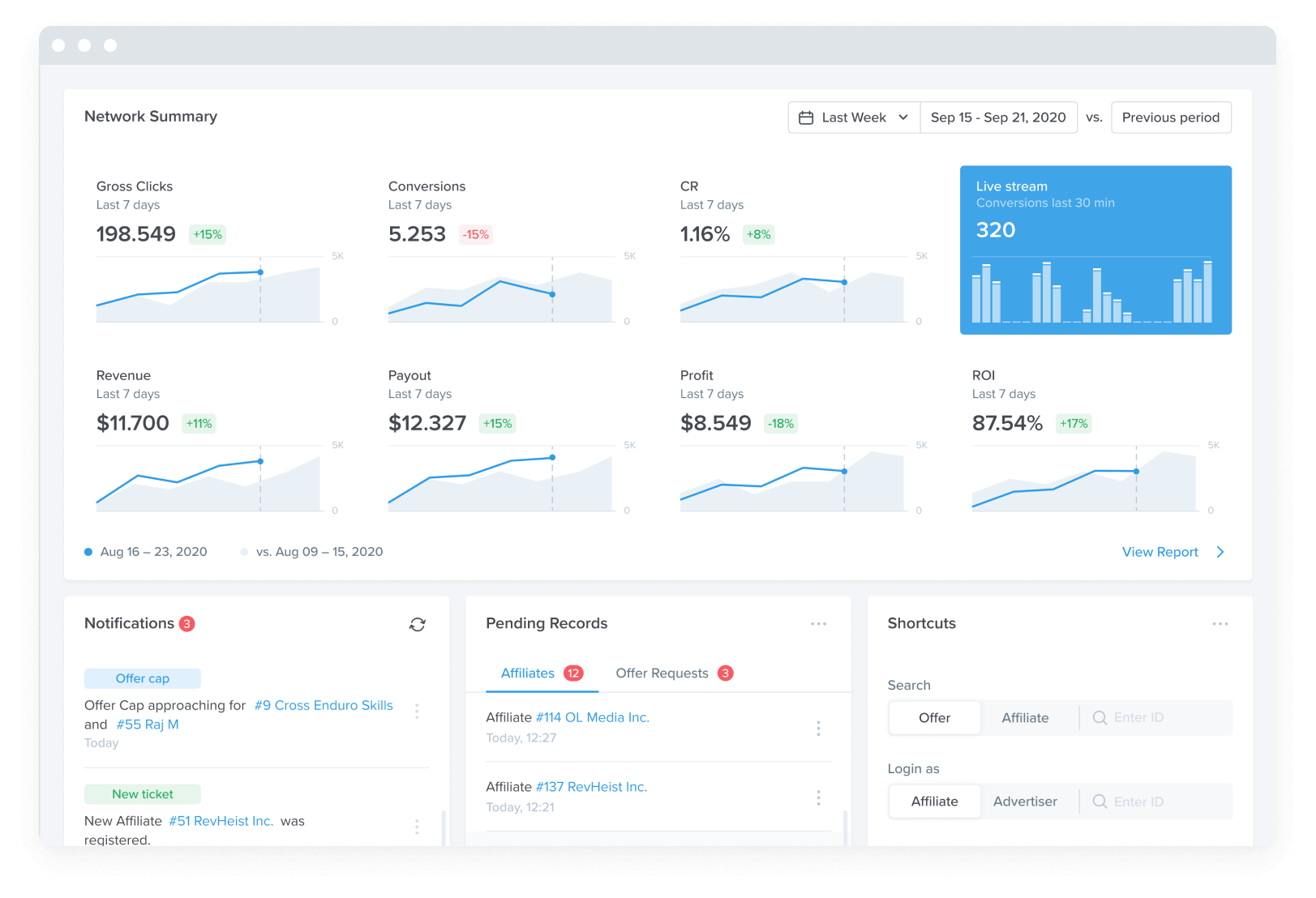

Industry Implementation Examples

4

Trolley payouts are commonly used by:

- Affiliate marketing networks

- Creator monetization platforms

- E-commerce marketplaces

- SaaS partner programs

- International contractor systems

Organizations distributing recurring or performance-based payments often require structured automation.

Business Impact

Reduced Administrative Work

Automation minimizes spreadsheet management and manual bank uploads.

Increased Scalability

The infrastructure adapts to growing transaction volumes without significant operational restructuring.

Structured Compliance Management

Integrated documentation workflows support organized regulatory processes.

Financial Visibility

Centralized dashboards provide real-time oversight into payout cycles.

Deployment Checklist

Organizations evaluating trolley payouts typically assess:

- Geographic payout coverage

- Compliance requirements

- Technical integration needs

- Accounting system compatibility

- Projected payment volume growth

A phased rollout plan often improves implementation efficiency.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment services designed to streamline international disbursement workflows.

Can trolley payouts support large-scale operations?

Yes, the platform is built to handle high-volume batch processing.

Does trolley payouts include multi-currency functionality?

Yes, multi-currency support is integrated into the payout infrastructure.

Is trolley payouts suitable for marketplaces?

Yes, marketplaces frequently use payout automation to manage vendor settlements.

Conclusion

Trolley payouts provide structured infrastructure for automating complex global payment operations. By combining onboarding, compliance workflows, multi-currency distribution, and centralized reporting, the platform supports scalable and transparent financial processes.

For digital businesses expanding internationally, centralized payout automation can enhance efficiency, reduce risk, and support long-term operational stability.