Trolley Payouts for Global Platforms: Strategic Guide to Mass Payment Automation

Introduction

As digital ecosystems expand, payment operations become increasingly complex. Platforms distributing earnings to creators, vendors, affiliates, or contractors must handle cross-border regulations, tax documentation, and multi-currency settlements.

Trolley payouts provide a centralized infrastructure designed to automate these workflows while maintaining transparency and regulatory structure. This guide explores how the system supports scalable global disbursement operations.

Company Background: Trolley

Trolley specializes in automating large-scale payment distribution for international businesses. Its platform integrates:

- Recipient onboarding

- Payment orchestration

- Tax form collection

- Compliance documentation

- Financial reporting dashboards

This unified approach reduces reliance on fragmented banking systems.

Operational Model of Trolley Payouts

4

1. Recipient Onboarding & Data Collection

Recipients submit:

- Payment account information

- Required tax documentation

- Identity verification details

Structured digital onboarding minimizes errors and standardizes compliance documentation.

2. Payment Execution & Orchestration

Trolley payouts support:

- Domestic bank transfers

- International disbursements

- Multi-currency settlements

- Batch payment cycles

Automation allows companies to process large payment volumes efficiently.

3. Compliance & Documentation Workflow

The compliance layer assists with:

- Tax form validation

- Secure document storage

- Reporting preparation

- Audit trail maintenance

These workflows help organizations maintain structured regulatory alignment.

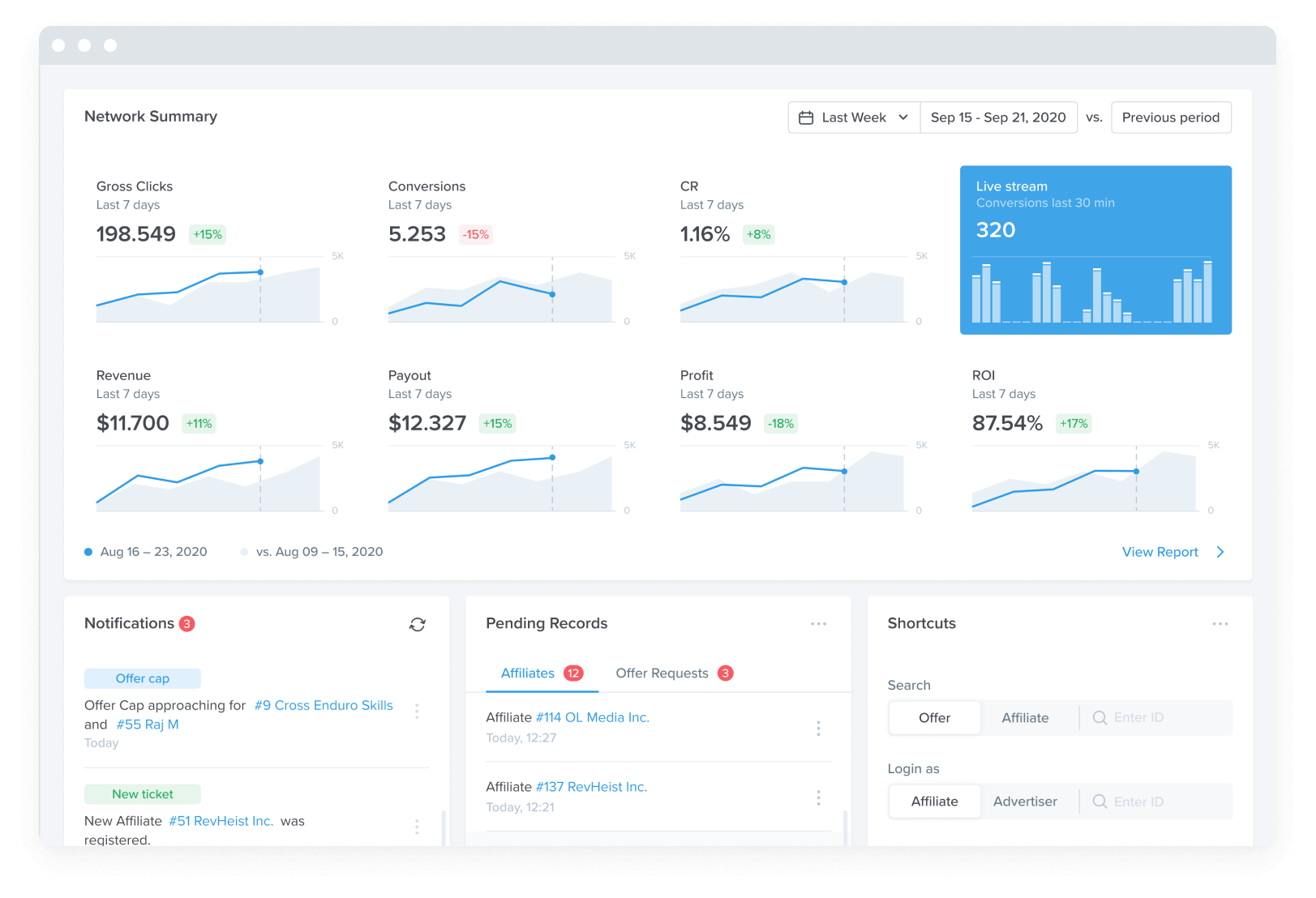

4. Monitoring & Reporting

Finance teams gain access to:

- Real-time payout status

- Currency conversion data

- Transaction logs

- Exportable reconciliation files

Centralized reporting improves operational visibility.

Core Strengths of Trolley Payouts

Automation at Scale

Bulk payout capabilities reduce manual administrative effort and streamline distribution cycles.

Multi-Currency Flexibility

The platform supports payments in multiple currencies, simplifying cross-border operations.

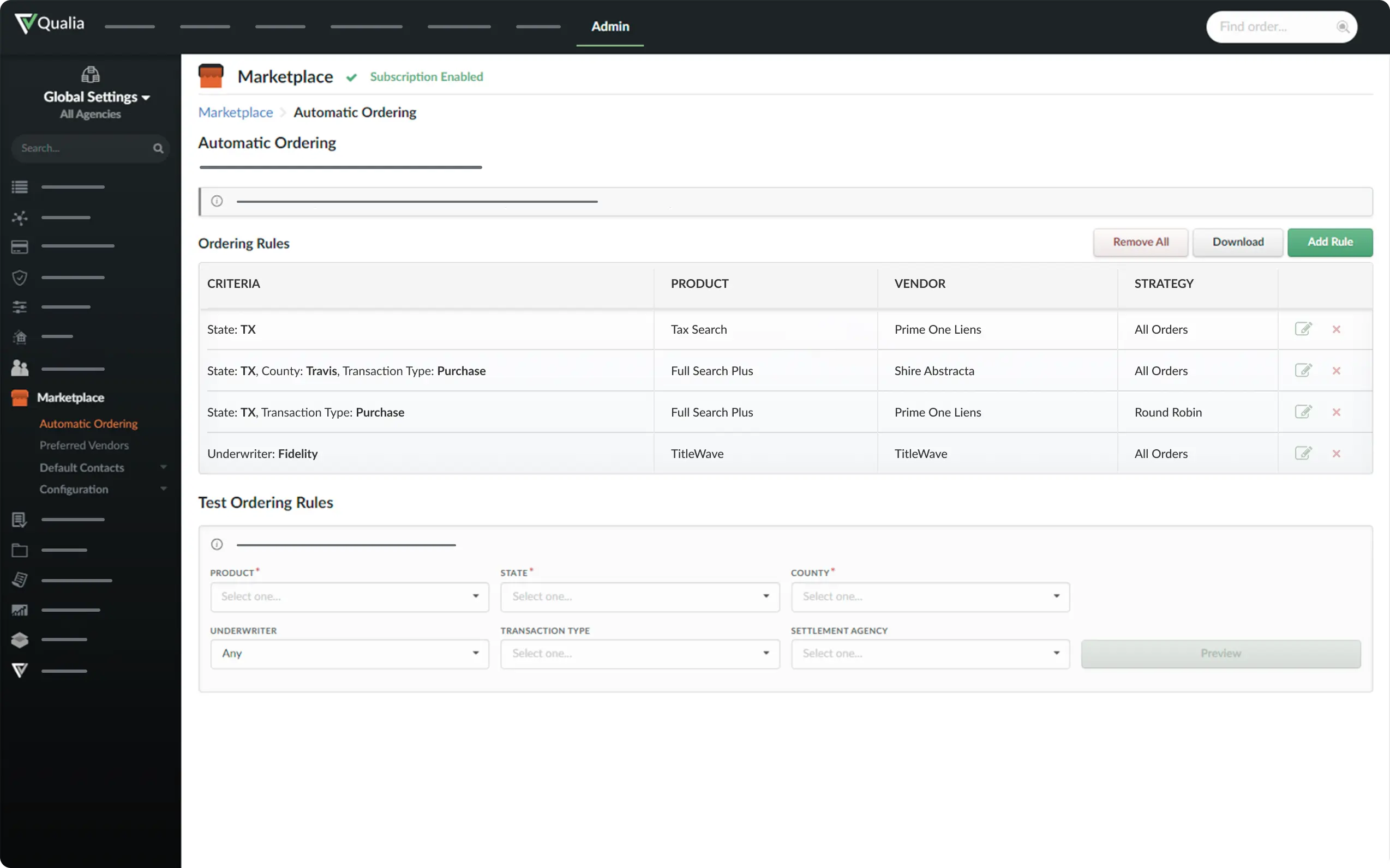

API-Based Integration

Developers can embed payout workflows directly into internal systems and marketplace platforms.

Enterprise Security Controls

Common safeguards include encrypted data transmission, role-based permissions, and detailed audit logs.

Industry Use Cases

4

Trolley payouts are widely implemented by:

- Affiliate marketing platforms

- Creator monetization ecosystems

- E-commerce marketplaces

- SaaS partner networks

- Global contractor management systems

Organizations with recurring or high-volume payout structures benefit most from automation.

Strategic Benefits

Reduced Operational Friction

Automation replaces manual spreadsheets and fragmented bank uploads.

Scalable Infrastructure

As payout volumes increase, the system adapts without requiring proportional staff expansion.

Structured Compliance Support

Integrated documentation workflows help maintain organized regulatory processes.

Financial Transparency

Central dashboards provide oversight into payment cycles and historical transaction data.

Implementation Considerations

Before deploying trolley payouts, organizations typically evaluate:

- Geographic payout distribution

- Compliance obligations

- Technical integration requirements

- Accounting software compatibility

- Growth forecasts

A phased integration plan can support smoother adoption.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment services designed to streamline international disbursement workflows.

Can trolley payouts handle large-scale payment cycles?

Yes, the infrastructure supports batch processing for high transaction volumes.

Does trolley payouts support multi-currency payments?

The platform includes native multi-currency distribution capabilities.

Is trolley payouts suitable for marketplaces?

Yes, marketplaces frequently use payout automation to manage vendor settlements.

Conclusion

Trolley payouts provide enterprise-grade infrastructure for managing complex global payment operations. By combining onboarding, compliance automation, multi-currency distribution, and reporting tools, the platform reduces administrative burden and supports scalable international growth.

For organizations operating across borders, structured payout automation enhances efficiency, transparency, and long-term operational stability.